Asset Turnover Ratio Increase Means

The current ratio is 275 which means the companys currents assets are 275 times more than its current liabilities. Low turnover of stock ratio indicates.

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

C Total asset to debt ratio.

. Since the working capital ratio measures current assets as a percentage of current liabilities it would only make sense that a higher ratio is more favorable. This move is very risky as by doing this the organization is taking on the burden of too much debt and eventually they have to pay the debt with interest. So a higher asset turnover ratio is preferable as it reflects more efficient asset utilization.

Its not risky but it is also not very safe. A WCR of 1 indicates the current assets equal current liabilities. C Total asset to debt.

A Debt equity ratio. Revenue is a crucial part of financial statement analysis. Accounts Receivable Turnover in year 1 was 285 days.

Asset-based income tax regime has the meaning given by section 830- 105. Current ratio Current assetsCurrent liabilities 1100000400000 275 times. An asset turnover ratio of 3 means for every 1 USD worth of assets and sales is 3 USD.

Interpretation of the Ratio. The meaning is quite. This means that the firm would have to sell all of its current.

For instance an asset turnover ratio of 14 means youre generating 140 of sales for every dollar of assets your business has. You can also use our Receivable Turnover Ratio Calculator. A high AR turnover ratio is usually desirable but not if credit policies are too restrictive and.

The asset turnover ratio shows the comparison between the net sales and the average assets of the company. The companys performance is measured to the extent to which its asset inflows revenues compare with its asset outflows Net income is the result of this equation but revenue typically enjoys equal attention during a standard earnings callIf a company displays solid top-line growth analysts could view the. It means that the company was able to collect its receivables averagely in 285 days that year.

A ratio of 04 means youre only generating 040 for every dollar you invest in assets. B Weak sales and over investment in stock. The receivables turnover ratio is an absolute figure normally between 2 to 6.

Current ratio is a useful test of the short-term-debt paying ability of any business. Some sectors like retail will more likely see a good ratio around 2. A Strong solvency position.

Which ratio is used to analyse the capital structure of a company. The accounts receivables ratio on the other hand measures a companys efficiency in collecting money owed to it by customers. D Monopoly in business.

A receivable turnover ratio of 2 would give an average collection period of 6 Months 12 Months 2 and similarly 6 would give 2 Months 12 Months 6. Particulars Company A in. A ratio of 21 or.

Assets are reported on a. As an illustration using a PE ratio of four for a business that makes 500000 post-tax profits means it would be valued at 2000000. Assessment day for an income year of a life insurance company has the meaning given by section 219- 45.

Total Asset Turnover Revenue Average Total Assets Fixed Asset Turnover. Others particularly that are service-based will have a much lower ratio. A high turnover may indicate unfavourable supplier repayment terms.

The fixed asset turnover ratio reveals how efficient a company is at generating sales from its existing fixed assets. Turnover is the income that a firm generates through trading goods and services. If any company wants to increase the equity turnover ratio to attract more shareholders it may skew the equity by increasing the debt percentage in the capital structure.

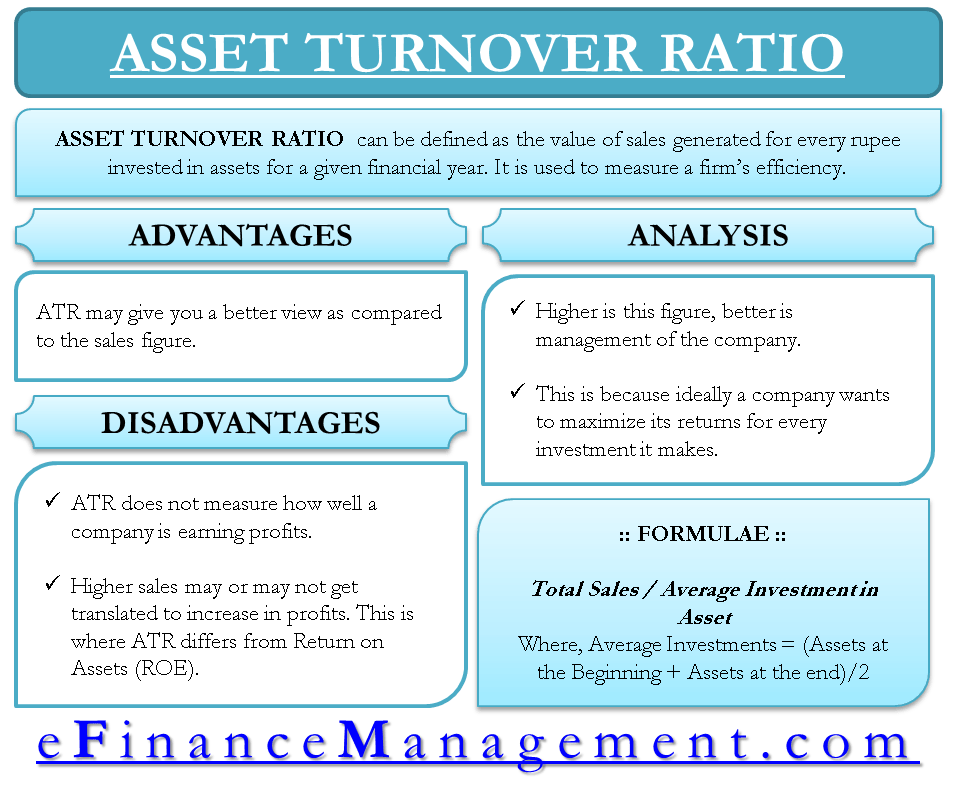

How you arrive at the right number for your PE ratio can vary dramatically depending on the business. Compare your days in accounts payable to supplier terms of repayment. An asset turnover ratio measures the efficiency of a companys use of its assets to generate revenue.

A ratio of 1 is usually considered the middle ground. The higher the turnover the shorter the period between purchases and payment. Revenue is the total value of goods or services sold by the business.

A higher ratio implies that management is using its fixed assets more effectively. D Gross Profit ratio. A low turnover may be a sign of cash flow problems.

Thats why its. An asset is a resource with economic value that an individual corporation or country owns or controls with the expectation that it will provide future benefit. Turnover ratios that are used widely are inventory turnover ratio asset turnover ratio sales turnover accounts receivable and accounts payable ratio.

In year 2 this ratio increased indicating that the company needed 303 days to collect its receivables. Asset of a sub-fund of a CCIV means any of the assets of the sub-fund ascertained in accordance with Subdivision B of Division 3 of Part 8B5 of the Corporations Act 2001. Accounts Receivable Turnover Days Year 2 325 3854 360 303.

However as with other ratios the asset turnover ratio. And if a business has a good record of repeat earnings it may have a higher PE ratio too. Equity Turnover Ratio Example.

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

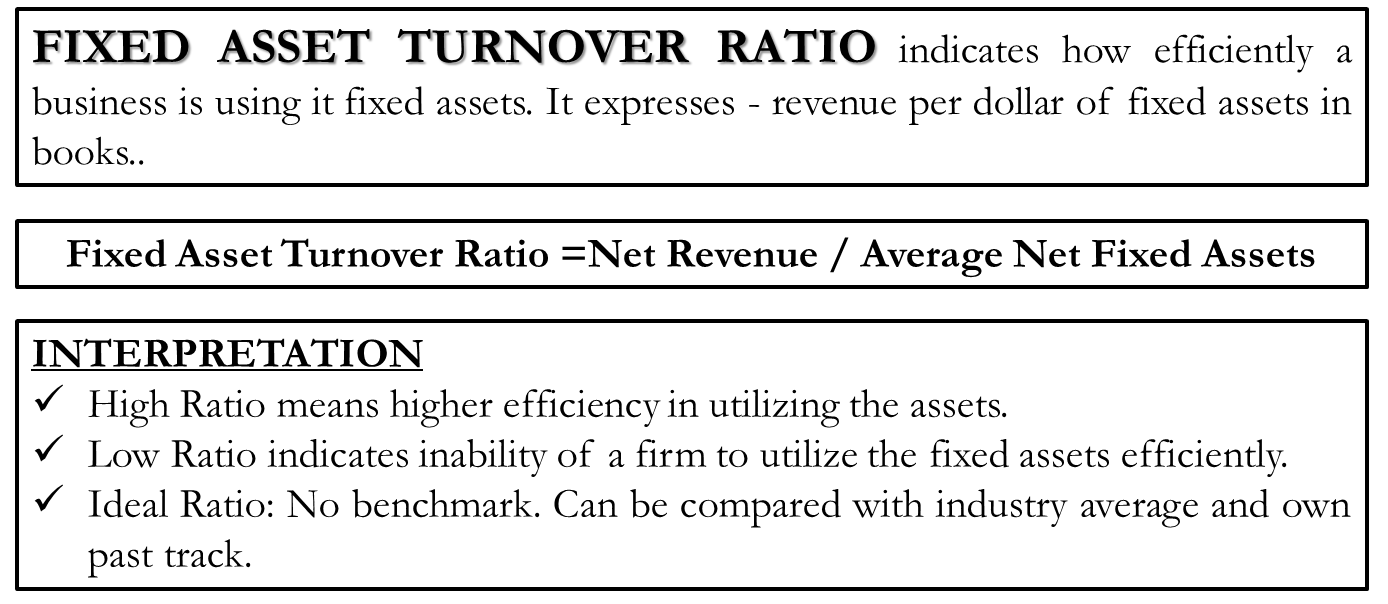

Fixed Asset Turnover Definition Formula Interpretation Analysis

Asset Turnover Ratio Formula Meaning Example And Interpretation

No comments for "Asset Turnover Ratio Increase Means"

Post a Comment